Ethiopia’s Enigmatic Investment Policy

Fana Broadcasting Corporation (FBC) reported, quoting Office of the Prime Minister, that “[o]n the margins of the Belt and Road Forum (BRF), the Ethiopian Investment Commission (EIC) has signed memoranda of understanding (MoUs) with four Chinese companies that have decided to invest in Ethiopia”. FBC listed target sectors:

- Taison Group and Green Diamond will establish a large-scale bamboo pulp-paper manufacturing in Assosa, Benishangul Gumuz regional state with a capacity to manufacture 1 million tons pulp paper per annum.

- Amity Printing will set up a printing factory in Ethiopia.

- CGCOC Group establish a fully integrated livestock and meat processing plant with an annual slaughtering capacity of 300,000 cattle and 3 million sheep in Awash, Fentale.

- Zhende Medical Products Manufacturing agreed to invest in a pharmaceutical plant in Kilinto Industrial Park to manufacture wound care, surgical sensory, pressure therapy and fixed products, the office indicated.

On August 3, 2018, Xinhua reported, quoting Mekonen Hailu’s, Communications Director at EIC, that “[t]he Ethiopia Investment Commission (EIC) has licensed 1,294 Chinese investment projects during the Ethiopian Fiscal Year 2017/18”. Chinese investment projects accounted for 24.8 percent of the total investment licenses Ethiopia issued in that year.

It should be noted that these are investment licenses issued in just one year. EIC has not revealed the cumulative number of Chinese investments it has licensed over the years.

However, in a piece entitled Ethiopia’s China challenge, the Africa Report, a news organization based in South Africa, stated that in addition to those licensed in 2017/18 “[t]here are about 400 Chinese investment projects valued at more than $4bn already in full operation in Ethiopia. A good number of this are based within industrial parks and the real estate sector.” This means there are at least 1,694 Chinese businesses licensed to operate in Ethiopia. The latest news indicates that the number of Chinese businesses in Ethiopia will continue to grow in the coming years.

It is extraordinary that China had a 24.8% share in total number of investment licenses issued in Ethiopia in a single year. It wouldn’t be concerning if this share was expressed in terms of some other indicators, for instance, total value of investments. The reason is that the weight of the sum total of Chinese investments are expected to dwarf the total sum of small investors, particularly domestic ones, given each of the Chinese large investors would come with a relatively large capital.

However, the fact that the 24.8% share actually represents total number of licenses is simply shocking. In this connection it is appropriate to raise a few interrelated questions. The secrecy surrounding vital public policy matters in Ethiopia means it is impossible to know much details. For instance, was the 24.8% Chinese share from total investment licensed to both domestic and foreign businesses or a share in total Foreign Direct Investments Ethiopia licensed in that year? In any event, what kind of things does EIC consider as “investment”? And more generally, what are the roles and functions of EIC?

I have tried to seek answers to these and other questions related to EIC for quite some time but to no avail. I have closely followed EICs activities but there isn’t much information out there to provide better insights into EIC’s roles and functions.

There is no confusion about EIC’s official remits. On EIC’s website, it is stated that “[p]romoting the country’s investment opportunities and conditions to foreign and domestic investors”. This means, at least in principle, EIC is supposed to support domestic as well as foreign businesses.

One thing is clear though: EIC is extremely active in attracting foreign forms but we do not hear EIC doing much as far as domestic investors support is concerned. But if EIC sees its remit in attracting foreign business, then it has to be made formal, and it needs to be renamed as the Ethiopia foreign direct investment commission (EFDIC). This would also leave some room for another authority with responsibility to support domestic investors.

Now if EIC’s remit is to serve both domestic and foreign investors, then EIC is left to explain how on earth it issued so many licenses to the Chinese big firms when millions of Ethiopians have been crying out to start businesses and create jobs for tens of millions of Ethiopians.

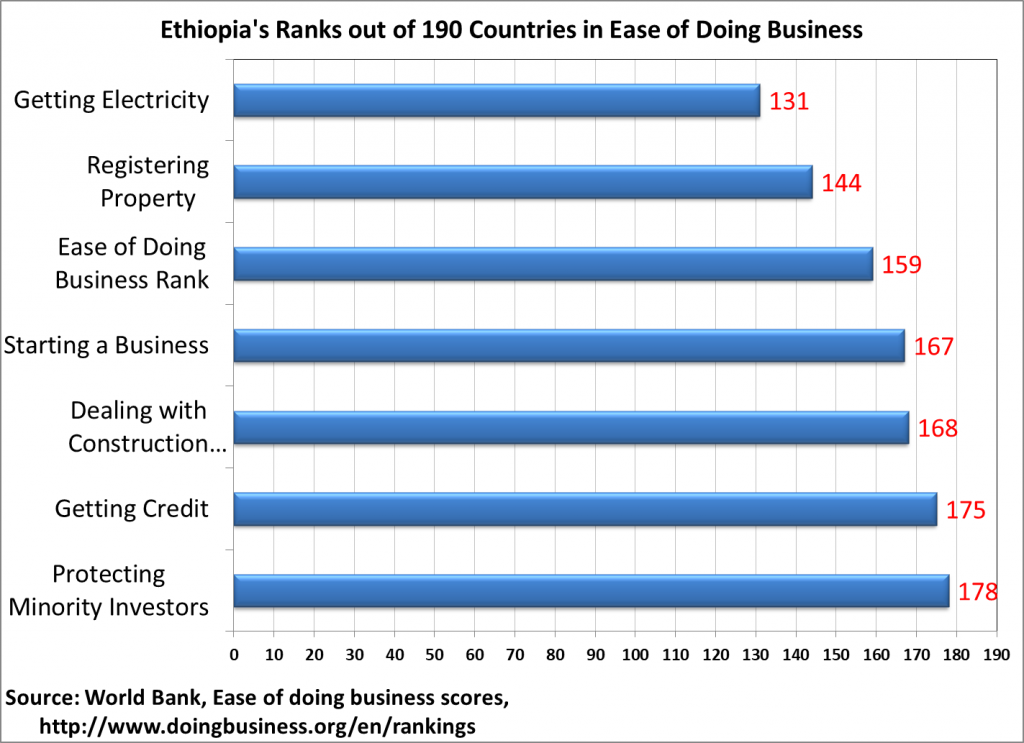

Perhaps EICs fuzzy remits and its excessive obsession with foreign investment is responsible for Ethiopia’s dismal records in doing business environment rankings in the world. The data shown below is plotted from the World Bank database, May 2018 version. The figures show Ethiopia’s position in ranking of 190 countries in terms of various indicators related to ease of doing business.

I am certain if the 190 countries were ranked according to “doing business by foreigners”, Ethiopia’s rank would come near top of the list. This indicates it is Ethiopia’s domestic investors who bear the brunt of cruel investment policies. It is time that Ethiopia shift focus and start to favorably treat domestic investors.

I suspect the root cause of the troubles lie in EICs layperson approach to understanding investment as a concept. Apparently EIC thinks of investment as something to do with a shiny metallic structure, the kind Chinese firms and other foreign investors would put up and provide instant gratification to the officials.

However, an Ethiopian youth who wants to do, for example, a dairy farm should be treated more favorably than a Chinese investor who wants to do business in one of the industrial parks. Similarly, EIC should be enlightened to know that a farmer who has land should be encouraged to invest in a number of interrelated capital formation activities; such as fencing, water tanks, and tree plantation, etc., to improve productivity of their plot. Land improvement is by far the most important category of investment or capital formation that the Ethiopian authorities should take very seriously.

Finally, it is worth returning to EICs latest venture to China and its new photo opportunity at the end of signing the MoUs. No doubt that there are thousands of domestic investors crying out to do those businesses. Paper and pulp is not a sophisticated manufacturing activity that require huge foreign investors. There are Ethiopian operators in the existing branch.

Even more puzzling is the cattle slaughtering business for which EIC has invited Chinese operators. Why bother to invite a foreign giant to slaughter cattle? It is understandable for Ethiopia to use Chinese expertise to build railways, dams, and highways. However, it is beyond me to comprehend why Ethiopia needed Chinese hands to construct residential flats.

I conclude with an anecdote. I recall hearing a Sudanese University professor expressing his anguish that the Chinese have taken everything there was to produce in his country. He thought there one item was spared for the Sudanese small business: knitting Kufi (a rounded head cap worn by Muslim men). But his hope was dashed when he saw a street vendor with a version Kufis manufactured by a Chinese firm. One should not be surprised to find a Chinese gaabii or bullukkoo somewhere in Addis stores.

2 Comments

Berhanu Adenew · 2019-04-26 at 19:26

Great and timely analysis, as usual, by Dr Ayele. Yes, no doubt that eventually and soon they will make us enjera, if things take the current trend. You are quite right, there is now, for instance, the Chinese version of ladies’ dress, just like ye habesha kamis (with all types of designs and colors, exact copy) coming from China and flooding the Ethiopian market threatening the existence of the Shiromeda cottage business market. It is to be recalled that many years ago the Chinese cheap shoe dumped onto Ethiopian market ruined several tens of small producers of shoe, many of them went bankrupt once for all. Unless improved in recent years, what was worrisome in the previous Chinese investments in Ethiopia, is the issue related to labour and employment. Quite often the investments involve hiring workers from China itself while Ethiopia severely suffers unemployment especially of the young graduates. The EIC needs to have a policy (hope it has it nominally) of reserving certain sectors for domestic investors. If the constraint that hinders domestic investors is lack or shortage of capital to import technology or capital goods, money borrowed by the government can be partly allocated for the same purpose, since the Chinese are also lending while they are investing, any way.

Tullu Liban · 2019-04-27 at 12:09

Thank you Dr. Ayele Gelan for your brilliant observation as usual.

There are a number of mindboggling issues surrounding investment scenario in Ethiopia.

In my opinion, there should be a redefing of the conceptual framework of “investment” before inviting any venture to the country.

A. What is it meant by investment for us as a country? Is it a glittering plastic patch (greenhouse shelter) or “shiny metal structure” (to borrow your expression) that results not only in eviction of farmers but also pollution of the environment? One cannot overlook the saga floriculture farms.

B. What are our priorities, focuses and end goals?

C. Who is benefiting from the investment, particularly foreign direct investment? Can it complement local business initiatives or it would dwarf them?

D. How sustainable the investments are? What is our comparative advantage in uplifting life of the local communities?

These and other conceptual frameworks must be defined properly to correct the mess up in the sector.

To my understanding, the foreign direct investment policy in Ethiopia has been based (not sure if any change in ideology and practice is going on) on misguided premises

1. Political calculation: the much hyped but yet unyielding foreign direct investment is aimed at facelifting the EPRDF regime before the world that the country is doing business, in a peaceful environment, that there is stable government.

2. Doing business with the like-minded: TPLF officials never cared about national interests as far as wealth amassing was possible through corrupt deals with Chinese, Indian, Turkish companies visible or invisible. That is why any business firm be it small or big easily was given licenses. For your information there are Chinese and Turkish “investors” who are engaged in bricks production and sand sale, an activity which is virtually designated for local micro and small businesses.

As you correctly pointed out, why these Chinese licenses are not revealed to the public in terms of value? What are their area of engagement? How many jobs are created by each of them? When do they go operational and what will they bring to locals in terms of skill and technology transfer?

We can raise tons of question.

Finally, I believe that thoughtful intellectual observations and analysis you are producing will constitute your next book, Dr. Ayele.

Many thanks once again