Taming the Beast: Accepting the Parallel Market and Adopting a Dual Exchange Rate

PM Abiy Ahmed has done his level best to cope with Ethiopia’s foreign exchange crisis that he inherited. He used his charm offensive in public diplomacy, persuading multilateral and bilateral donors to stand by Ethiopia. He has achieved a great deal in that regard.

Solving Ethiopia’s foreign exchange troubles, however, is a bit like trying to shoot at a moving target. There are a number of parts simultaneously moving in different directions.

In a piece entitled “How Can Ethiopia Boost Remittance Inflows?”, I suggested a number of alternative ways to induce remittance inflows. In that piece, I touched on potential role of using a dual exchange rate as a temporary measure to get relief from the foreign exchange crisis. In this piece I will focus on a dual exchange rate system and explain how it can serve as a relief for Ethiopia’s foreign exchange headache.

Minding the Gap

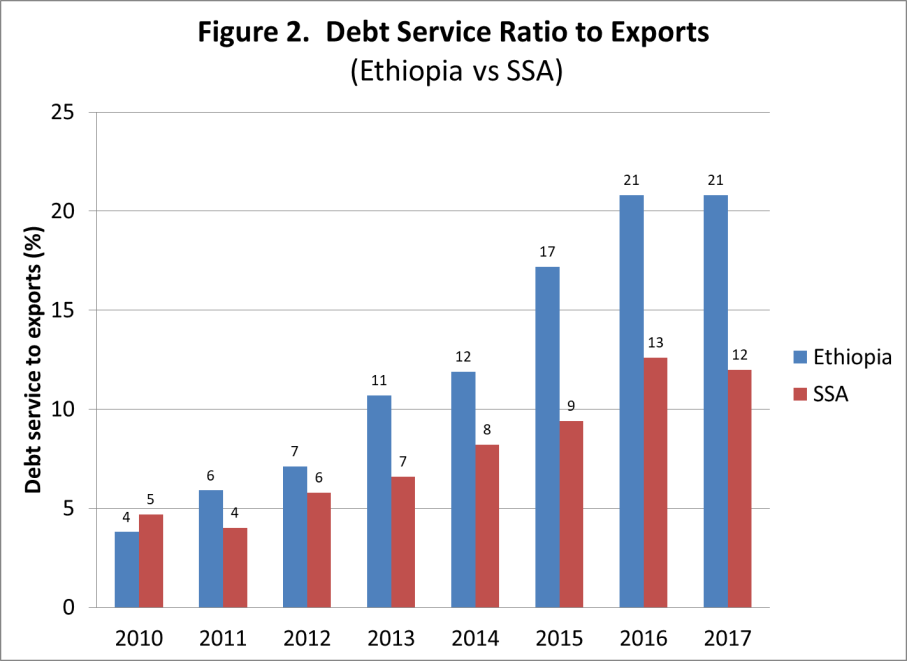

The gap between the official and the parallel rates is a good indicator of troubles in Ethiopia’s currency exchange. It is a composite indicator reflecting the dynamics among interacting parts.

Its size has always been widening over the years, but the situation simply have gone from bad to worse in recent months. The official exchange rate for one USD currently stands at birr 28.7395. I hear the parallel market rate in Addis Ababa has suddenly jumped to birr 41 per USD last week. This means the parallel market rate is nearly one and half times the official exchange rate.

In the past, Ethiopian authorities have tried to deal with parallel market by using only one means – brutal force to crack it down. At times, this helped to offer a temporary respite. However, it has never brought about a lasting solution to Ethiopia’s perennial problem with black market trading. As long as Ethiopia has not produced enough to export, providing an ultimate solution to the country’s foreign exchange crisis, it is inevitable that the parallel market will exist in one form or another.

The trouble with cracking down the black market currency exchange is that the authorities chase and close down only a small segment of the entire market. This is the case where the hard currency has physically entered Ethiopia and people try to trade it illegally in the domestic market. However, by far the largest proportion of the parallel market operation happens elsewhere in foreign lands.

The challenge black market causes to the Ethiopian economy is many fold. First, potential remittances would be completely sucked up by traders. Billions of dollars that would have been remitted to Ethiopia using official channels get diverted to the informal markets. The hard currency pooled together this way would be used by importers who would use it to buy goods and services to Ethiopia.

In order to match the large quantity of goods with the tiny fund allocated to them by the domestic banks, importer resort to under-invoicing. Because of this it is not even possible to be certain about the true value of imports reported in the country’s trade statistics.

A Dual Exchange Rate

Adopting a dual exchange rate is a trick through which exchanges in informal market is recognized and turned into formal channels, and currency officially arriving in domestic banks. Introducing a dual exchange rate means officially implementing two separate currency exchange rates side by side. How this gets operationalized depends on country contexts. This is done restricting each exchange rate to a certain transactions. The most straightforward method, which I propose for Ethiopia, is this:

- Retain the existing official exchange rate for current accounts transactions, i.e., continue using the current official exchange rate for commercial transactions in exports and import markets.

- Adopt the parallel market rate for financial accounts transactions, mainly remittances. Pretty much the way parallel market traders base their offers depending on market rates, the authorities would need to vary this second rate on daily basis. This will pre-empt any possibility of a third market emerging at some point.

Given that the second rate is market determined, there is no reason why anyone would resort to any other channel to send money to Ethiopia. The Ethiopian diaspora would send money at the same rate as in the parallel market with the only difference that this time the transaction would be done via official channels. In this manner billions of dollars that gets diverted abroad would be channeled to official routes and arrive in bank accounts of remitters or their relatives.

The adoption of a dual exchange rate effectively means accepting and working with the reality on the ground. Also, it is an admission that the parallel rate more correctly reflects the fundamentals in the currency market. If the parallel rate is a genuine reflection of relationships between supply and demand, then it would be wise for the government to accept and work with it.

Importers have made a lead and worked with it for decades. If importers used the parallel market and get things done, then there should be no reason whatsoever why the authorities would shy away from it. If they are reluctant to formalize the parallel market, then it means the authorities are making life unnecessarily tough to themselves. After all, the government has more control on Birr than the private traders. Printing more Birr and spending it on buying dollars is a sensible policy initiative.

While there is every reason to introduce the second rate, effectively embracing the parallel rate, there are compelling reasons to retain the current official exchange rate. The temptation to float the Birr has to be resisted by all means. The Birr would float when Ethiopia has built the capacity to produce enough and export. The argument that devaluation would induce export production may not necessarily hold.

The Birr has been devalued umpteen times already but still Ethiopia’s exports supply continued to stagnate. In the short to medium term, devaluation would simply make exports cheap and imports expensive. If you do not have enough to sell, then it would be foolish to deliberately make an offer to sell the little you have on hand at cheap prices. Deliberately making imports expensive is even more damaging, especially given that we know most of Ethiopia’s imports are necessities, such items as capital goods, medicine, fuel etc.

It should be clear that the dual exchange rate system should be seen as a temporary measure. Ethiopia will eventually graduate out of it. This comes with capacity building to enhance supply of exportable products and hence affordability to move to a floating exchange regime. At that point the two rates would converge, making dual exchange system redundant.

How Common is Dual Exchange Rate?

The adoption of dual exchange rate has been utilized by many countries. Several developed countries in Europe and developing countries in Latin America have used dual exchange mechanisms during 1980s and 1990s.

During the years it was implementing economic reform programs in 1980s, China has used dual exchange rate system. In early 1990s when it was undergoing fundamental political and economic transition, South Africa resorted to using dual exchange system to manage its currency exchanges.

Nigeria currently has about four separate exchange rates, each introduced to serve certain purposes. Ironically one of the four is the black market rate, which presumably hanged around due perhaps to lack of proper synchronization or timely updating of the rates in line with demand and supply relationships in the market.

What is clear from the brief discussion on country experiences, the introduction of a dual exchange rate is essentially a temporary measure either when an economy is under stress or when the economy is going through some fundamental transformations. In all cases, stabilizing the foreign exchange market becomes essential. When the stresses are relaxed and the economy is sufficiently transformed and stabilized, then the temporary measure would be made to phase out.

Win-win

In the current circumstances in Ethiopia, adopting a dual exchange rate provides by far the most effective policy option. To begin with all actors involved in foreign exchange would be winners from this arrangement. Focusing on remittances, we recognize three major players.

First, the government and the broader economy, currently billions of dollars get diverted through the black markets in the country as well as in foreign countries. All remittances will be transferred through official channels. This will boost the foreign exchange earning of the country, relieving the government from engaging in relentless search for hard currency from multilateral and bilateral donors.

Second, the Ethiopian diaspora would prefer the official channel to make transfers back home. Dealing with black market agents has always involved enormous risks. Hence, everyone would be relieved to know that they would regularly remit money through official channels to safely deposit into their bank accounts or bank accounts of their relatives back home.

Finally, black markets have existed primarily because of scarcity of foreign currencies in Ethiopia’s domestic banks. The scarcity existed partly because remittances would not arrive through official channels. If importers can get hard currency from domestic banks to finance their import businesses, then they would not have engaged in any frantic efforts to search for hard currency in illegal domestic and foreign markets.

This means adopting a dual exchange rate would be in the interests of all actors involved in foreign exchange. The total benefit to the economy would be much greater than the sum of the separate benefits to different groups of actors in the foreign currency market.

5 Comments

Gebawo Kedir · 2019-06-09 at 13:44

I will read thoroughly and reflect later on, but starting from your website (?) name “dinagddee.com” I suggest if you correct to __dinagdee.com! I’m suggesting that to correct the spelling of Afaan Oromoo. But, if you wrote purposely it doesn’t matter. Afaan Oromoo is our common wealth and identity. Thank you!

Ayele Gelan · 2019-06-09 at 14:19

Thanks Gebawo. I wrote Dinagddee on purpose. I do not belong to qubee generation. I thought myself how to write and read qubee. Since qubee is phonetic, you write what you vocalize, so I have not encountered any insurmountable troubles. Of course, I make mistakes very often because I do not drill qubee often enough.

After I wrote this domain name someone brought to my attention that dinagddee was wrong on the ground of a specific rule called irra buta. The domain name cannot change so I have got to live with it. At first glance I was convinced about irra buta. After some moments of reflection, however, I found it rather baffling.

The beauty of qubee is its pure phonetic nature. Now I feel irra buta has taken away a little bit of that beauty in my opinion. And for no reason.

From what I am told, irra butaa basically states if a consonant is preceded by another consonant then don’t repeat it even if the sound is strong. Dinagdee is a good example. Clearly d is a strong sound but because it is preceded by g, a consonant, then it is supposed to be just d rather than dd. Why? Irra buta said so.

Yesterday, I initiated a Facebook discussion with a few qubee generation. The answer I got was irra buta says so. Nobody tells me any logical explanation, pedagogic or otherwise, about this rule. Apparently it is taken as a matter of faith, as if it comes from some part of the scripture. Not good enough.

I would greatly appreciate if if you can provide me with some explanation. My curiosity has nothing to do with my domain name. It’s only a domain name and it does not need to be meaningful. But that word triggered a broader issue worth discussing.

If we have a rule we must be able to provide a logical explanation to justify its existence.

Nate Dars · 2020-05-22 at 14:05

Dear Ayele,

Thank you for your brilliant ideas and economic comments that you write all the time. I pretty much read from time to time. I wish to ask you two questions;

1- Have you had written an article on the upcoming idea of Stock Market in Ethiopia that the government is planning to implement soon. i cant find any. if not, my question is: is this a feasible idea to take on board at this time and if so how does it really work in Ethiopia from your point of view?

2- What is your perspective of having international banks to come into Ethiopia? Do you think it would help the economy and tackle the foriegn currency crises as well?

Look forward to your comments.

thank you

Ayele Gelan · 2020-05-23 at 07:52

Thank you for the kind words Nate!

Here are my thoughts on the issues you’ve raised.

1. To be honest I have not followed what was being said on government intentions to introduce stock markets in Ethiopia. Perhaps I heard but I did not pay attention. Over the years we are used to hearing government picking this and that, every trendy stuff from anywhere and talking about it without really meaning to do any thing serious with it. Regarding stock markets, I am not an expert on this area. I would need to look into the matter in some depth before I offer expert opinion on it. So what I say here can only be a layperson opinion on that particular topic. Stock trading requires a sound and vibrant economy, by that I mean the private sector. We do not have any. So who would trade in stock, which shares would be bought and sold, etc. I have no idea. A few clever billionaires can bring in huge dose of hard currency and buy everything. Then government will be required to stop wholesale of a handful company shares to foreign players, that is if they care about the national economy. Either way it is going to be a problem. The bottom line is this: the economy would need to pass a certain threshold in terms of vibrancy of the private sector. Then and only then stock markets trading would make sense. One has to pass through literacy and numeracy before contemplating to become a poet.

2. I am yet to write a full article bringing together my thoughts on Ethiopia’s banking and financial sector. I have an ambivalent viewpoint on this sector. First, of all economic policies the EPRDF has adopted over the years, I have admired and approved their dogged determination to say no to IMF and WB, saying no to foreign banks. Foreigners do not bring in anything. The money is printed by the NBE. All they do is open a small offers and shove money in and out to customers, sorry I am simplifying things a bit here. Sometimes I hear people saying “the foreign banks bring in new skills and management etc”. Well, very easy, if there is no banker skilled enough domestically, then hire highly skilled bankers to work in NBE, CBE or even the other private banks. The other thing commonly cited is foreign banks bring in hard currency. The fact is, they bring in with the intention and promise to take out as much as they want, when they want. And what they would remit out would be at least as much as what they brought in, chances are they would pump out more.

The role of foreign businesses should be limited to activities which no one in the country is capable of doing.

Nate Dars · 2020-05-25 at 11:25

Many thanks for your prompt reply and viewpoint.