How Much Does it Cost to Print Ethiopia’s New Currency Notes?

The Ethiopian government has announced today that the country’s currency notes are demonetized. The public is given a three months window to exchange old currency notes from the banks. The birr notes affected through this change were 100, 50, and 10 denominations.

The change includes introduction of a new 200 birr note. It seems the 1 birr notes and the coins will stay in circulation. For the duration of the three months, both the old and the new notes will stay in circulation side by side. The disclosed motivations for changing the currency notes were to combat hoarding, counterfeiting, corruption, and other illegal activities. It was reported that the country has spent about 3.7 billion birr ($101.2 million) to print new currency.

In this piece, I will discuss two interrelated points. First, I will look into credibility of the official figure related to cost of printing the notes. Second, I will briefly discuss the cost and benefit of printing new money, and if there were any other least cost options the officials might have needed to pursue.

I will start by trying to make sense of the officially announced cost of printing the new notes. The officials have not announced how many of each notes they have got printed and the cost variations in each category. In more transparent governance systems, it is common place to release such figures. National banks routinely print new notes each year to keep up with increasing demand for money, which in turn happens due to increases in the size of the economy, GDP growth.

For instance, India has built domestic capability to print her own notes. The Reserve Bank of India has the responsibility to release detailed figures as to how much of each note they printed each year together with cost of printing each category of notes. The latest figures they released indicated that it cost them 2.93 rupee ($0.0420) per 200 rupee note, 2.94 rupee ($0.0421) per 500 rupee note, and 3.54 rupees ($0.0496) per 2000 rupee note. Similarly, The US Reserve Bank provides detailed lists of cost per unit of currency notes they print. This ranged form $0.077 per $1 and $2 note to $0.196 per $100 note.

There is no tradition of releasing such vital information by National Bank of Ethiopia. However, we can triangulate the issue and get a sense of magnitude. For instance, in 2008 the Ethiopian government contracted the business of printing new notes to two separate European companies. The contract for birr 10, 50 and 100 was given to Giesecke & Devrient GmbH (German), and that of birr 1 and 5 to De La Rue (UK). The total value of all notes printed was birr 1.1 billion. Total cost of printing paid to both firms was $66 million ($50 million to Giesecke & Devrient GmbH and $16 million to De La Rue). This means on average $0.06 (or 6 cents) was paid for every birr printed (ignoring the denomination differences for the time being).

Now that we have extracted useful information relating to notes printed (from it cost per birr), we turn our attention to the possible number of notes (in their value terms) printed through the latest contract to print new notes, whoever has done the printing!

In a piece entitled “Ethiopia: Practical, Emblematic Changes for Nation’s Currency”, originally published in Addis Fortune and then reprinted on All Africa blog (Sept 22, 2018), Alemseged Assefa, Former Vice-Governor of the Central Bank, reported that “[D]uring the second quarter of the past fiscal year [2017], of the 104.74 billion Br in circulation, excluding the one Birr note that has been replaced by a coin and is no longer in circulation, the 100 Br notes amounted to 85pc of the total”.

It follows that, even if we ignore the new currency notes that were printed put into circulation since the second quarter of 2017, at least there is 105 billion worth birr notes is currently in circulation in the Ethiopian economy.

Now we establish that the claim that only birr 3.7 billion ($101.2 million) was spent to print Ethiopia’s currency notes does not make any sense. Remember USD$66 million was spent to print birr 1.1 billion in 2008. That was 12 years ago. We know the cost of printing is likely to have gone up over the last decade. Even if we accept the unlikely scenario of the cost of printing remaining unchanged at 2008 level, then we have already established that the total amount of money in circulation has enormously increased during the period.

If $66 million was spent to print birr 1.1 billion worth notes, then it follows that the cost of printing 105 billion birr currently in circulation must be $6.3 billion, that is by assuming the cost of printing money staying the same as in 2008. If the authorities have managed to find a contractor that can provide the service at very low cost, then this can be pushed down to something like half of this estimate, that is to say $3 billion.

Now let’s settle for the most ridiculous and unlikely scenario of getting a service provider who would print the 105 billion worth notes for $1 billion. Then how does this high cost compare with the envisaged benefits? I have to admit it would still be worth it if there was no other option.

In my opinion the government had other options that may cost the Ethiopian economy next to nothing. The trail of stolen and hidden money in Ethiopian society goes to two destinations. One is billions of local currency (birr) being illegally acquired and then stashed away under mattresses of crooks . The other one is billions of stolen dollars safely deposited in foreign banks.

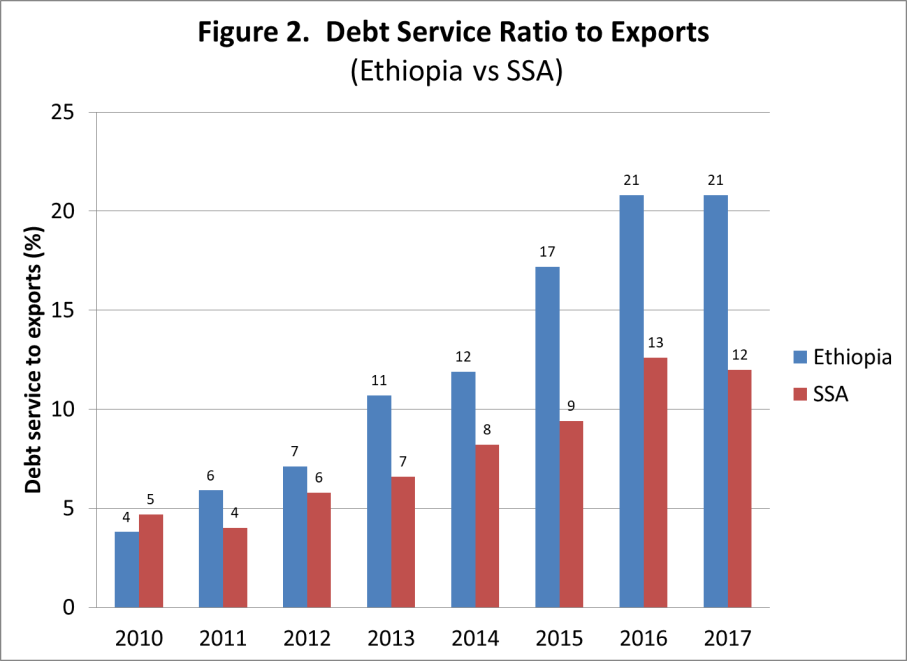

We know the government and the society would benefit a great deal more if the government turned its attention to hunting the billions of stolen dollars that left the country and deposited in foreign banks. Ironically, the government, the public and the international community know very well that it is the same group who are suspected of illegal money laundering in the domestic economy that have also deposited billions of dollars abroad.

It would make a lot more sense to follow the trail of the precious dollars in foreign banks rather than wasting so much public money to hunt for stolen birr. Needless to say that the government is suffering more from shortage of dollars than shortage of birr.

Now what remains to be explained is why the government is shying away from following stolen dollar trails? Pursuing dollar trails abroad is likely to reveal lots secrets that may affect broader group of individuals, not only former comrades and current enemies but also those who are still friends in arms in the current government. Following stolen birr trail, on the other hand, is a safer option, after all everything starts and ends locally and enemy can be a lot more easily be sorted from friends. Of course, that is at the cost of wasting colossal public money but then again who cares to economize public funds.