Ethiopia Needs Evidence-Based Economic Reform

Ethiopia needs a deeper economic reform agenda that is rooted in evidence-based decision-making. A cursory glance through Ethiopia’s economic literature leaves one to wonder if there are two Ethiopias. On the one hand, official reports paint a rosy picture. It has often been referred to as one of the fastest-growing economies in the world, consecutively registering double-digit GDP growth for over a decade. On the other hand, a lot of Ethiopians disagree with the flattering remarks of the economic success story by diplomats and foreign commentators.

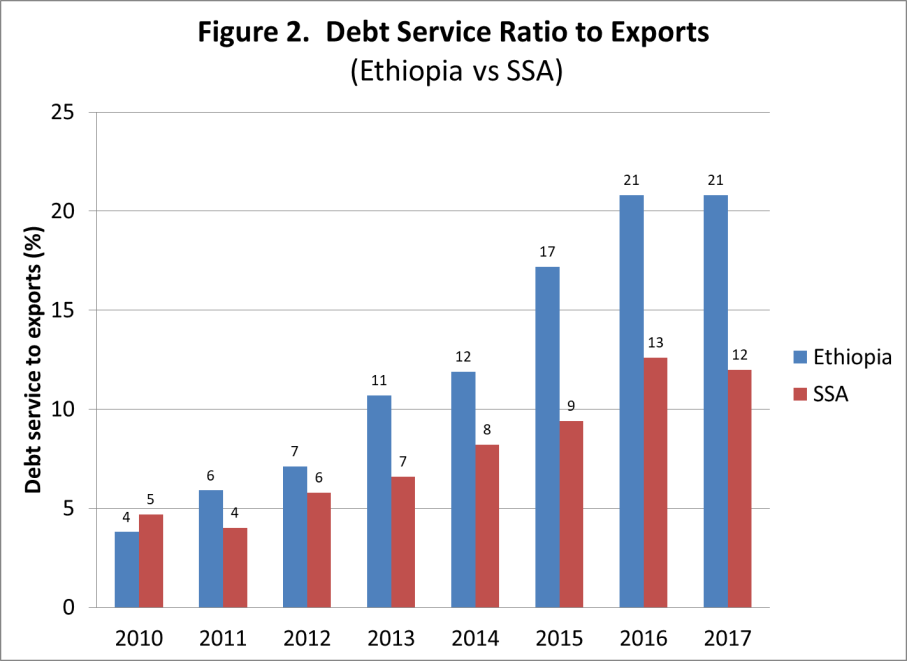

About a fifth of Ethiopia’s population still survives on food aid, particularly if one chooses to include households who have been purposely thrown under the rubric of the Productive Safety-Net Programme. Oblivious to the appalling inconsistencies in their storytelling, even the architects of the Ethiopia rising narrative regularly release scary statistics on Ethiopia’s abysmal record on fundamental economic indicators like business start-ups, foreign debt, capital outflows and balance of payments.

Prime Minister Abiy Ahmed’s (PhD) administration has been sending rather confusing signals on the fundamentals of the country’s economy. On the one hand, the phrase “to continue with the economic success of the previous decades” appears in most official reports. On the other, the authorities admit major policy blunders of the EPRDF government. For instance, the existence of success stories hinged on significant public sector investments. However, official reports have confirmed that large public investments like sugar projects and METEC have been colossal failures.

The primary source of the confusion lies in the unreliability of Ethiopian official economic statistics. It is crucial to rectify flaws in the national economic accounting, the ultimate source of evidence to formulate sound economic reform.

The public sector has dwarfed the rest of the economy thanks to the legacy of the “developmental state” model. Success stories in the private sector are limited to foreign firms or party-affiliated crony businesses. Ethiopia’s reform package should target neglected domestic private enterprises.

Private sector development has already been misconstrued as “privatisation”. What is desperately needed is nurturing private enterprises that are likely to generate jobs and absorb millions of the unemployed.

There was no rationale to rush into privatising public enterprises, particularly those that are most lucrative in terms of government revenue generation. Singapore has a relatively large number of public enterprises that run no less efficiently than private enterprise.

Ethiopia’s development strategy has gone through sudden lurches from one priority to another for much of the last three decades. The Agricultural Development Led Industrialization (ADLI) was a sensible start. Sadly, a dramatic shift to industrialisation occurred prematurely without registering any meaningful achievement with ADLI.

This proved to be perhaps the deadliest policy blunder EPRDF has committed. The consequences of misguided policies in agriculture cannot be hidden. It surfaces through food shortages.

Throughout Ethiopian economic history, priority to agriculture has come only in terms of pious words, with no substantive interventions in terms of investment. I sometimes wonder how investment in agriculture has been quantified. Often capital expenditure on vehicles used by rural party officials gets registered as investment.

Expenditure on improving livestock breeds or land improvements are unfamiliar in the vocabulary of Ethiopia’s economic statistics. We need to get back to basics. There is no shortcut to implement both growth and transformation, the two keywords so carelessly crafted into buzzwords of development strategy.

“Big is beautiful” has been the motto of EPRDF’s economic policy. This bias cuts across sectoral divides, as severe in agriculture as in industry. The consequences of bias against smallholder agriculture and SMEs in the urban areas have been catastrophic, causing much of the chaos coming through open and disguised unemployment.

Ethiopia’s Small and Medium Sized Enterprises (SMEs) used to be among the most vibrant in Sub-Saharan Africa. For instance, SMEs in leather manufacturing were success stories. Visitors used to cherish travelling to Ethiopia to go back with leather products.

It would have been wise to nurture and promote domestic SMEs in leather manufacturing rather than obsessively pursue foreign investment, attracting international giants that trumped local SMEs.

Ethiopia’s job creation at massive scales would make it compulsory to emphasise nurturing SMEs. Pretty much like agriculture, SMEs received only empty gestures. Their access to credit has been abysmal.

The trade policy has always been anchored on the foreign exchange requirements, hence heavy emphasis has been placed on the external sector. The domestic market size advantage has rarely been recognised. The agriculture industry or rural-urban linkages need to be rejuvenated.

Structural transformation means a transition in the structure of the economy from a traditional rural-agriculture-based economy to modern urban-industrial sectors. It seems not enough effort was made to enhance structural transformation that is rooted in productivity increments in the traditional sector to release resources required to expand the modern sector. The scope of the Growth and Transformation Programme has essentially been confined to the modern sector, leaving agriculture to take care of itself.

The growth and transformation strategy should be accompanied with sound income policy to enhance the purchasing power of households in both the rural and urban areas. Unfortunately, Ethiopia has followed a misguided income policy: low wage being understood as a comparative advantage, a perverted notion of comparative advantage.

The expression “low wage” does not convey the severity of the matter. On average, an elementary school entry-level teacher earns about one-seventh and a high school director about one-thirteenth of those in Kenya. Yet the cost of living in Addis Abeba is slightly higher than that of Nairobi.

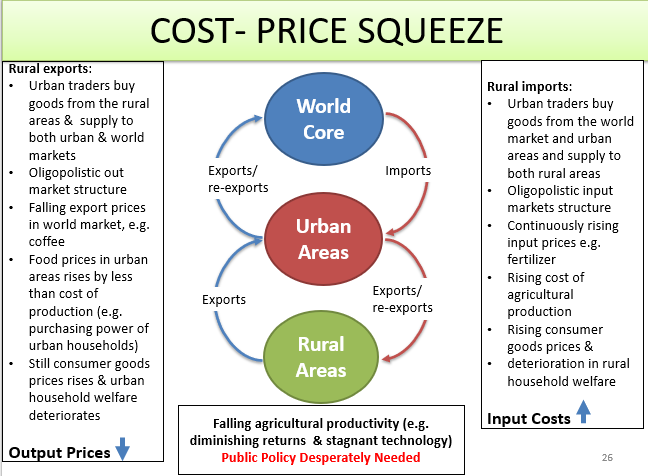

Ethiopia’s wage needs to be comparable to wage rates prevailing in neighbouring countries. After all, imports are priced at the same level. In fact, purchase prices of imported goods are considerably higher than in most other developing countries, because it has an oligopolistic import market structure. There are very few importers and they have the power to fix prices in the market place. Domestic producers encounter a double squeeze: the rising cost of production and feeble purchasing power. Farmers, in particular, have suffered the most in this double squeeze.

Ethiopia has an Investment Commission, but it is primarily designed to serve foreign investors exclusively. The rhetoric on domestic investment is somewhat baffling. There is a high level of awareness about the role of investment and capital formation. Even a layperson in rural Ethiopia can pronounce the word “investment” with the precision of a native English speaker. However, what exactly is classified as investment and how investment is promoted in the media is a great source of concern.

A good example is advertisements on TV variety shows during holidays. Every locality trips over each other to advertise and promote their locality as an investment destination. It sounds as if the local people openly declare they are incapable of doing anything useful unless someone comes from elsewhere. This begs the question: why don’t the local administrators enable local people to invest in their areas?

This requires strengthening titles to properties, such as farmlands, so that farmers could borrow from banks using it as collateral. The youth should be able to start off-farm small businesses using their family properties as collateral.

Small investments by millions of farmers in rural areas and owners of SMEs in urban areas would lead to improvements in manufacturing and agricultural activities that would add up to a considerable boost. They may not be big and visible like mega projects that are suitable for publicity, but small investments everywhere would do wonders. The era of making big investments just to show off should be over.

A fundamental shift is required to expand domestic credit to the private sector, particularly SMEs and smallholder farmers. Banks should be given the responsibility to finance good projects and help small business. It should be stressed that interest rates are exceptionally high. It is unthinkable that any small business would become profitable borrowing at interest rates as high as 18pc.

The authorities are overly concerned with foreign exchange, but they seem to do little to achieve this objective. Billions of dollars can be generated by devising suitable policy options. There should not be any limit to combinations of available options. For instance, why not “tame the beast?” That is to say, accept the parallel market and adopt a dual exchange rate?

The National Bank of Ethiopia has introduced a few directives during the last few months. However, each time they have come nowhere near what is required.

The directives on remittance flows prove the financial authorities have often violated Occam’s Razor: making more assumptions than necessary or deliberately targeting complexity rather than simplicity.

Ethiopia’s growth policy has generated rampant inequalities between people and places. A combination of policy instruments required to address imbalances discussed so far can contribute to reductions in chronic income distribution problems. I will focus on inequalities between places, particularly those between the centre and the periphery.

There is no country on planet earth where the capital city is allowed to outgrow the rest of the cities in the urban system like Addis Abeba. In 2015, its population was more than ten times the second largest city, Adama. This ratio, called Zipf ratio in urban economics, is usually expected to be around two.

Lopsided growth is costly and wasteful. It is reported that about 60pc of the electricity generated goes to Addis Abeba, but it has less than five percent of Ethiopia’s population. Similarly, over 50pc of vehicles and travel mileage happen in and around the capital. Addis Abeba is heating up, while towns in the peripheries are ice cold. A deeper economic reform would be framed to incorporate a suitable urban development policy that would reduce lopsidedness.

The purpose of listing the interrelated policy issues is to suggest the scope of the economic reform that would be needed to encompass them. This does not mean that each of the dimensions would require separate reform programmes. Policy instruments, such as taxes or subsidies, are supposed to have synergetic outcomes.

A particular tax or subsidy can serve multiple ends like promoting small businesses as well as influence their locations, away from the centre to the periphery. These are the most fundamental economic challenges that subsume layers of economic issues.

Originally published on Oct 05, 2019 Addis Fortune [ VOL 20 , NO 1014] , https://addisfortune.com/ethiopia-needs-evidence-based-economic-reform/