Short-term Gain, Long-term Pain?

China has cancelled interest on all loans to Ethiopia that were taken out before the end of 2018. China has also extended the terms of its loan to Ethiopia to finance Railways from ten to thirty years. These have been celebrated by many on social media and elsewhere. As far as I am aware, however, the size of the cumulative interest that China has cancelled for Ethiopia has not been revealed. The amount of loan China extended to Ethiopia to finance the Railways was just over US$4 billion. But what are costs and benefits of extending loan terms for this loan by twenty years? In this piece, I will attempt to present some facts relevant to broader issues related to Chinese loan to Ethiopia. Figures presented in this piece are generated by using data obtained from China-Africa Economic Bulletin #1: Challenges of and opportunities from the commodity price slump.

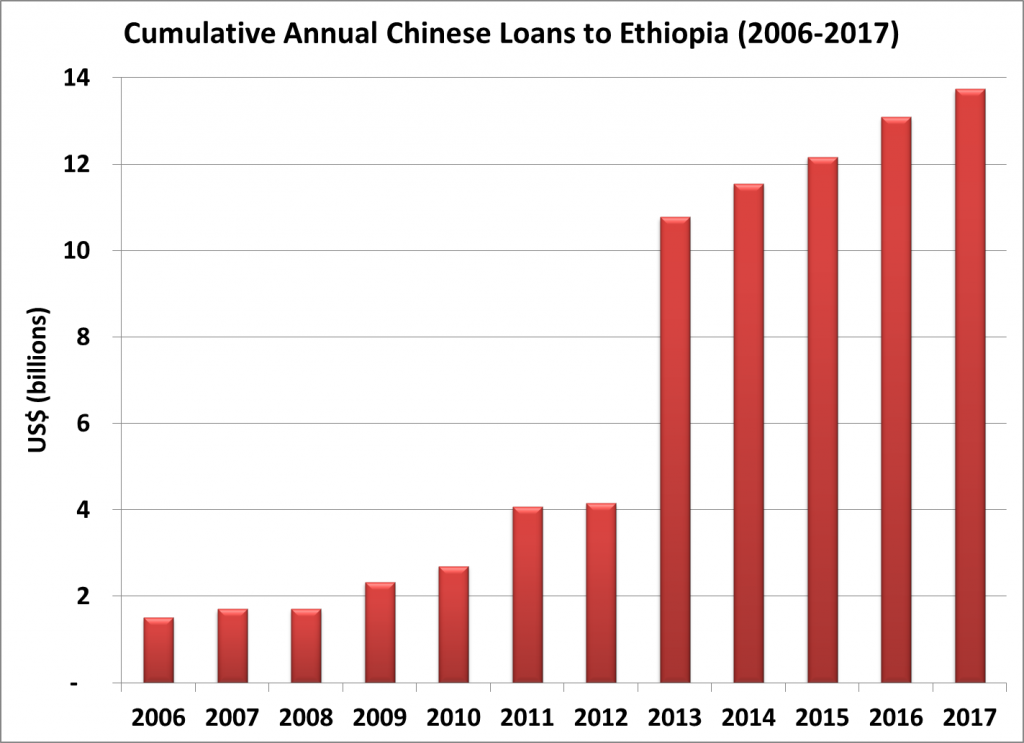

How much does Ethiopia owe to China?

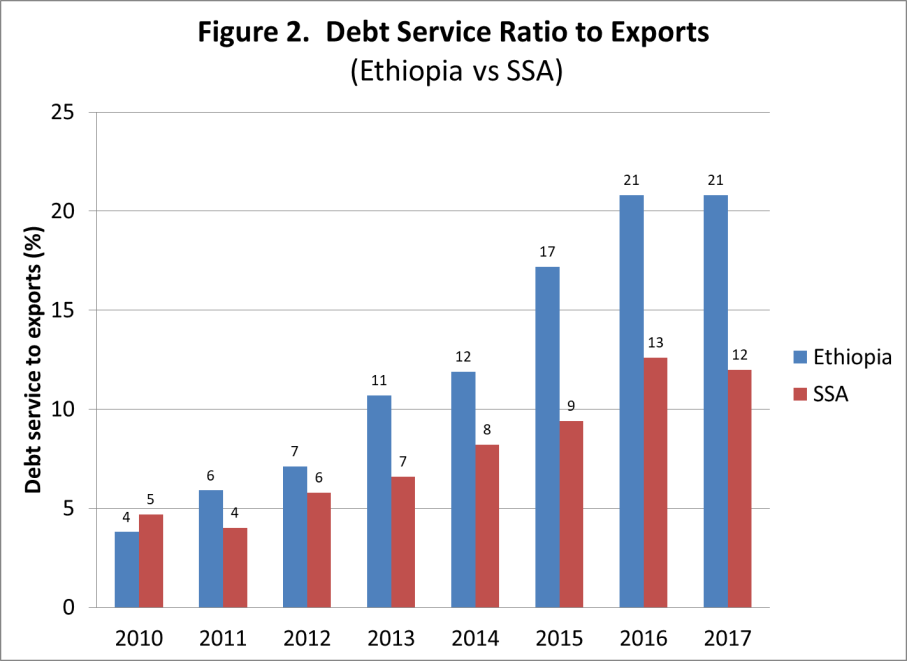

Around year 2000, Chinese loan to Ethiopia was a mere US$ 1 million. By 2017, cumulative Chinese loan to Ethiopia over the 17 years period rose to nearly US$ 14 billion. After Angola, Ethiopia became the second largest borrower from China. It should be noted that the outstanding loan could be lower than this amount given that Ethiopia must have been financing its loans at least for some of the years during the period but such data is not available. The data source presented here does not present interest and principal repayments. In any event, Ethiopia must have encountered some trouble coping with repayments, perhaps long before the latest crisis.

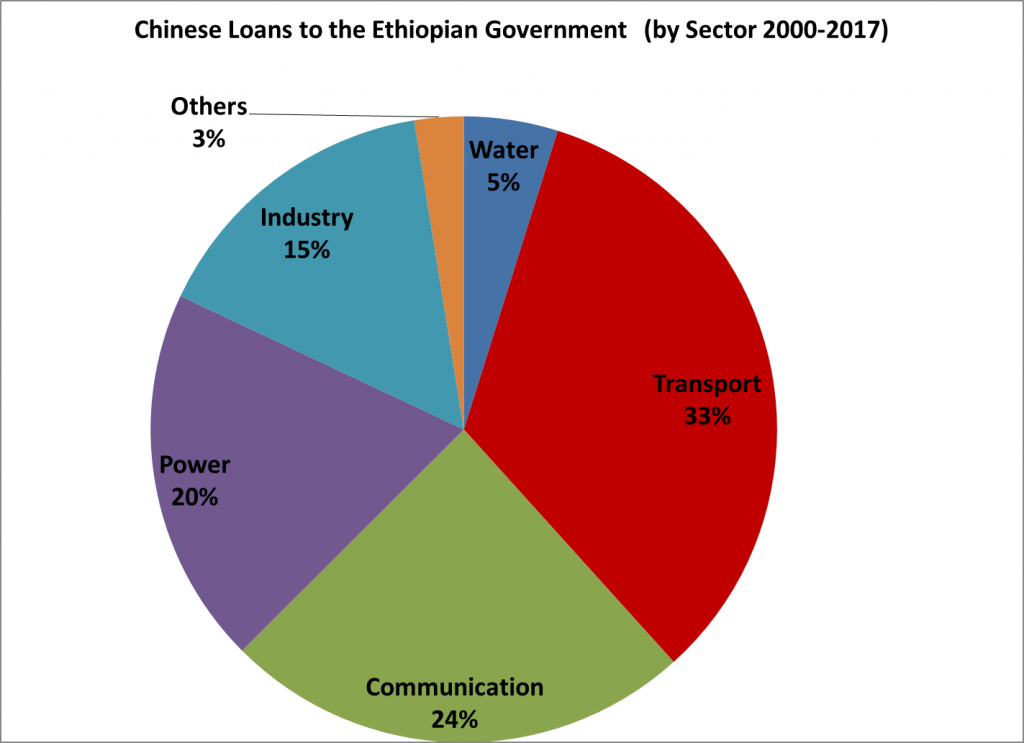

What were the loans used for?

The largest portion of the loan (33%) was used to finance the Ethio-Djibouti and Addis Ababa Light Railways. Communications is the second largest beneficiary of the Chinese loan, with 24% share in sectoral allocation of total loan. Sectoral allocation of the remaining amount were given as follows: Power (20%), Industry (15) and Water (5%) and Other Sectors (3%).

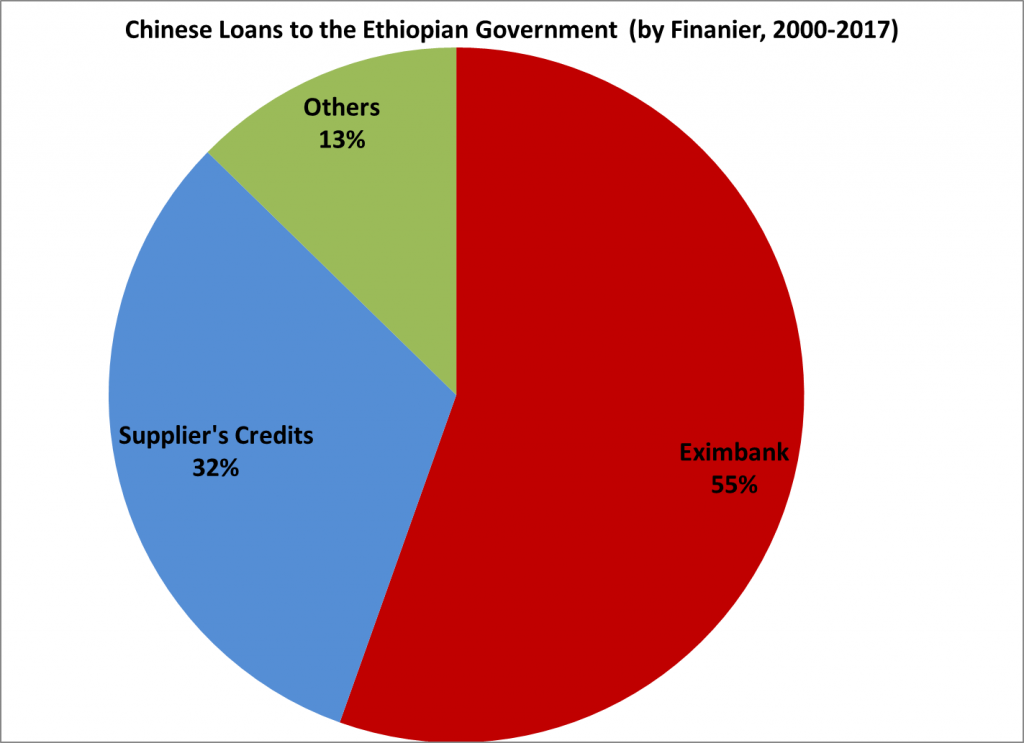

What type of loans was China Extending to Ethiopia?

Chinese Export-Import Bank (EXMIBANK) takes the largest, about 55% of total cumulative loans during the period under discussion (2000-2017). Suppliers credit comes second, with a share of 32%. This means the bulk of Chinese loan to Ethiopia (87%) are commercial loans. This indicates that the interest rates and conditions of lending tend to be much stricter than bilateral loans between governments.

What are the implication of Extending a loan repayment period?

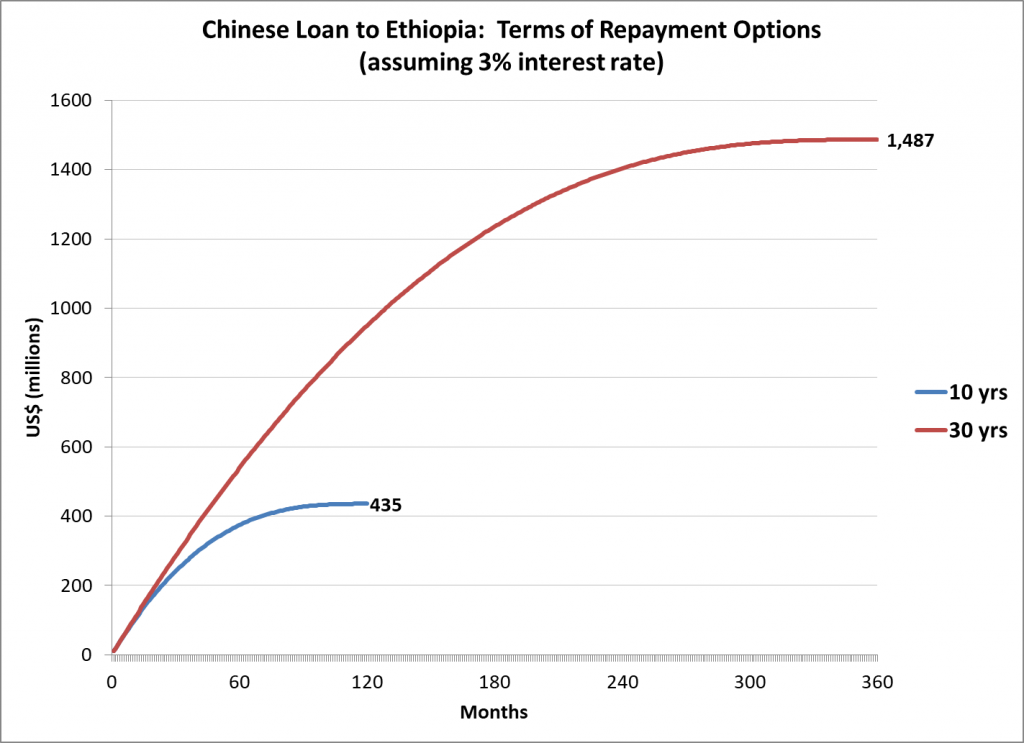

Extending loan repayment period has pros and cons. The advantage comes in terms of a short term relief of debt burden. I would hasten to add that the short term gain comes as long term pain. The extent of long term pain would depend on the terms under which the loan was extended. The renegotiated interest rate would play a vital role. In the case of Ethio-Chinese loan, there are no clues regarding the original or the renegotiated interest rate. For the sake of illustration, I have used a 3% interest rate, a highly conservative estimate. Given that Chinese loan to Ethiopia tend to be commercial, their interest rates are likely to be greater than 3%.

According to my calculation, if Ethiopia was in a position to repay the loan within the 10 year time scale as originally agreed, and provided that the interest rate was 3%, then cumulative interest payment would have been US$435 million. However, if we apply the same interest rate, and increase the payment term from 10 years to 30 years, then interest repayment would add up to US$1.5 billion. This would mean the extending the terms of loan repayment comes at a colossal cost to the Ethiopian economy, requiring more than threefold interest payment than would have been the case if the original repayment term was maintained.

Concluding remarks

I am prompted to write this piece for two reasons. First, I noticed numerous people exchanging congratulatory messages on social media because Ethiopia has got a favorable treatment cancellation of past interest payments and extension of loan repayment period. In the circumstances, it is understandable that, given the economic difficulty Ethiopia is finding itself in, it was not possible for the Ethiopian authorities to keep the original repayment term of 10 years. However, the fact that Ethiopia is extending its repayment by 20 years is not something to be excited about. As discussed earlier, it is just a short term relief in anticipation of inevitable long term pain.

Second, PM Abiy must have worked hard to achieve the two objectives: cancelling past interest payments and loan term extensions. He must have worked relentlessly, pleading to the Chinese authorities and using his good will in public diplomacy. He found himself in that position because Ethiopia was not able to carry its debt burden. Paradoxically enough, in the mean time, PM Abiy seems to be negotiating a deal for yet another round of sizable loan required, among other thing, to “beautify Addis Ababa”. In my opinion, this simply defies logic, it amounts to consuming alcohol to treat hangover.